- Counterpunch

How the world could stop Bush, Dump Dollars, ... The US is totally

dependent upon foreigners (China, Japan, largest) to finance its

budget and trade deficits. By financing these deficits, foreign

governments are complicit in the Bush Regime's military aggressions

and war crimes

- Cultural

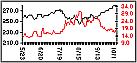

Economics The relationship between oil consumption, expenditures

and recessions ... oil price hike recessions (1973, 1979, 1990 and 2000)

- Democratic

Underground "Saudi Arabia has refused to cut interest rates

in lockstep with the US break the

dollar currency peg in a move that risks setting off a stampede out

of the dollar

-

- DissodentVoice,

Socialism, 1 percent of US population owns 50 per cent of the

wealth.

- Information

Clearing House Saudi Arabia, South Korea, China, Venezuela,

Sudan, Iran, Russia among first countries to sell dollars, fall 2007

more at NFU finance page

- JackLessinger

The fall of the consumer economy and the rise of the responsible

capitalist. ... Mercantile

Aristocrat of the 1700s through to the intersection of the Consumer

Economy and the Responsible Capitalist

- Online

Journal "China’s "nuclear option" to dump the

dollar is real"MarketOracle.co.uk

depress consumer spending,

- Rediff

US current account deficit is current account surplus in countries

that export to US, to cover US borrows from those countries, holding

up the value of the dollar. Asian countries are just as much to

blame as US. Limitations to system. Global

imbalance. US has to have 5% interest rate to keep foreign

investment flowing in... so can't cut rates to stimulate in face of

'housing' recession

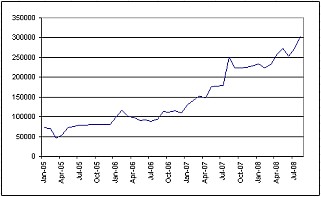

- Notes: Among those filing

bankruptcy were New Century Financial Corp., Quality Home Loans,

Aegis Funding, HomeBanc Mortgage Corp. and People's Choice Financial

Corp. ...

- RealityZone,

The Creature of Jekyll, you'll never trust a banker again

-

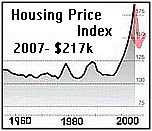

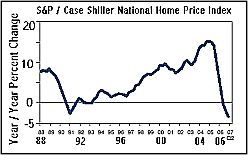

- notes: five reasons why we are

closer to a recession, (1) Inverted Yield Curve is followed by a

recession, demand for short term loans is down, indicating a cooling

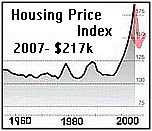

economy, (2) Falling housing prices, 10-25 % predicted, no telling

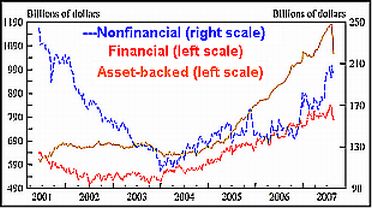

how long it will last, consumer spending slowing, (3) Credit

Crunch, subprime mess, check LIBOR for indicator of resistance in

interbank loans, fear, (4) (5) Falling dollar, foreign

countries don't want to buy our debt in a currency that is losing

value,

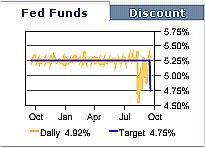

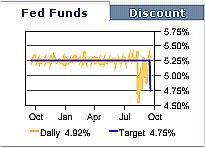

- Fed cut rates to fix emerging

markets stock collapse in 1997, 1998 ... cut rates for tech bubble

crash, cut rates for housing crash, what's next, credit cards?

- WhatEverHappened,

Federal Reserve, legalized counterfeiting

- notes: "While history shows

emerging markets have the greatest potential for growth, they are

also susceptible to some of the biggest declines. The Mexican peso

devaluation in December 1994 led to a 24 percent drop in developing

nations' stocks, while Thailand's decision to let the value of its

currency fall on July 2, 1997 spurred a 37 percent loss in six

months. Emerging- market shares fell another 19 percent after Russia

defaulted on $40 billion of debt on Aug. 17, 1998." Bloomberg

- Roadblocks, in subprime

solutions,

|

-

- Summary, Saving the Dollar

- Bloomberg

Rising Euro is what China needs to dump dollar, the R-word,

- Democratic

Underground Saudi Arabia has refused to cut interest rates

in lockstep with the US

- Bloomberg,

Bank of Korea urges shipbuilders to settle contracts in won,

- Rediff

US current account deficit is current account surplus in countries

that export to US

- Financial

Sense, China dumping dollars, and Financial

Sense, China

- Tehran

Times Japan Corporations pay

for Iran oil with Yen. Iran requested this.

- Bloomberg

yield curve, Oct 2007

- Bloomberg,

Currency controls, Nov 2007

|

- Action

Economics, repo market, no employee is associated with any

financial ...

- BBC

Market Data

- Bankrate,

foreclosures formula

- Bloomberg

Rising Euro is what China needs to dump dollar, the R-word,

- Bloomberg,

Canada, Subprime Panic Freezes $40 billion of Canadian Commercial

Paper, search terms: September 25, 2007, Baffinland Iron Mines Corp,

freeze in market for short-term debt, Toronto, defaults on subprime

mortgages in Southern California and Florida, cash in commercial

paper, debt backed by mortgages, corporate bonds, auto loans, all

stable for decades, yielded 1 percent more than commercial paper,

government debt sales fell because of government surpluses,

Libor is benchmark for commercial paper rates, no alternative plans

for liquidity, locks up system,

- ChartingStocks

market crash

- CommodityOnline

The Fed saved the stock market Aug 2007

- CSM

Missing $2.9 Trillion

- DailyFX

- DailyReckoning

- Energy

Bulletin News by region, industry, company

- Everbank

- Financial

Sense, China dumping dollars, and Financial

Sense, China

- Financial

Sense, Is This the Modern Day 1931

- Financial

Times Foreign investors flee US securities, TIC report, ... how

vulneralble the dollar is to a continuation of the credit

crunch-risk averse environment, lack of corporate bond

inflows,

- Financial

Times,

- GATA

Gold Anti-Trust Action Committee, Times of London, doubts about the

quality and disposition of gold reserves in UK, British and US

governments don't want citizens to know about their gold

reserves,

- Generational

Dynamics stock market crash 2007

- Gold

Eagle, book value, Dow and GE

custodial holdings of treasuries for foreign central banks

- Gold.org

- GoldandSilverInvestments.com

- Gold Field Mineral Services,

- GoldSeek,

meltdown, sept

22

- GravMag

oil

- Gulf

News "Qatar last week said its $50 billion sovereign wealth

fund has cut its exposure to the dollar by more than half to about

40 per cent of its portfolio."

- Gulf

Times "Middle

Eastern investors, led by the Arabian Gulf, will spend as much as

$300bn on Chinese equities through 2020 to build relationships in

Asia and secure higher returns, according to Merrill Lynch.

- Hometrack.uk housing price index

- International

Energy Agency tracks China oil demand

China data

- IPODesktop

- JSMinset

Foreign Central Bank holdings of treasuries ...Fed Custodial Account

holdings for Foreign Central Banks

- KYIVPost

As the US Dollar continues its slide, Ukraine’s central bank is

likely to strengthen the country’s national currency, a move that

would boost the purchasing power of average Ukrainians while taking

a bite out of the margins of export-oriented big business tycoons.

- MarketOracle.co.uk

recessions Third Leg of Bear Market

- Metal Bulletin trying to ascertain

the quality of UK gold reserve condition, does it meet London Good

Delivery (LDG) standards, substandard condition,

- MoundReport

- New

York University, Voodoo economics, debt,

- SafeHaven,

Dow 36000 or 3600?

- SFGate

Fed Rate Cut Can't Pull Home Builders Out of Free Fall"

- StockMarketCrash.net

- Stabroek

News, Guyana, depreciating dollar, causes, consequences,

devaluation after decades of dominance, status as an international

currency, world stock market equities valued in dollars, nominal

anchor for exchange rates, is the hegemony threatened,

- Strong,

Ed .. run on the dollar,

- Telegraph.uk

China threatens 'nuclear option',

- This

is Money.uk dfg

- TreasuryDirect.gov

- Treasury

Department Treasury International Capital System TIC reports,

historical data

- Wikipedia,

Velocity of Money

- WorldWatch Institute

|

- Barclays \

-

$80 Billion, Dubai construction projects,

2007 and see Taiwan ETF: EWT

- Bank of

England hedge funds

raid,

- Money

CNN.com deterioration of gold reserves, mint condition?

99.9 pure? adulterated by a base metal? assay marks not as important

as assay certificates,

- Bloomberg

"Sept. 19, 2007 ... Bloomberg

yield curve, Oct 2007

- Bloomberg,

Bank of Korea urges shipbuilders to settle contracts in won, spread

sales of currency forward contracts, hedging activities, to curb

won's gains against the dollar,

no

more Bush Clinton? no

more Bush Clinton?- BreakingNewsUpdate,

Debka, Situation Room, October Market Crash, commodities, inflation

- Citigroup, gold being used for the

surreptitious manipulation of markets,

- CNBC,

editorial policy of avoiding negative news? like a stock

market crash 2007

- Cosmo Oil, Japan, will pay for Iran

oil with yen. Oct 2007 ... pressure from Washington to limit Iran's

dealings with US financial system

- Credit

Derivative Research, Corporate default insurance, super senior

debt, corporate debt, pension funds, hedge funds, write-downs,

credit crunch, tranches,

- DLC

Democratic Leadership Council

- Fars

News Agency (IRAN)

Japan Corporations pay for Iran oil with Yen. Iran requested

this. 1944 Bretton Woods, allowing the US to accumulate

trade deficits and fiscal debts without consequence,

- Fool.com

Market crashes

- FoxNews, five reasons why we are

closer to a recession, Inverted Yield Curve is followed by a

recession, demand for short term loans is down, indicating a cooling

economy,

- HSBC,

gold used to prop up currencies in times of adversity, used to

finance emergency imports, Gordon Brown decision to sell 400 tonnes

of gold between 1999 and 2000, Chancellor, government sales of

reserves down.

- Japan Energy Corp will pay for Iran

oil with yen, Oct 2007

- Library

of Economics and Liberty

- London Bullion Market Association

- Market

Watch Bond reinvestment risk, in a interest rate cut environment

- Merrill Lynch

- Minyanville

Ron Paul " ... I think moral hazard begins at the very moment

that we create artificially low interest rates which we constantly

do.

- Mortgage

Bankers Association mortgage applications data

- MSN,

Epic Bear Market

- New

York Federal Reserve, search data on China dollar

- Nippon Oil, Japan refiners pay for

Iran Oil with yen

- Royal Institution of Chartered

Surveyors

- Tehran

Times (IRAN)

Japan Corporations pay

for Iran oil with Yen. Iran requested this.

- Zillow

notes:Defaults are soaring. Home sales and prices are falling.

Business is thin for real estate agents and mortgage brokers. But

the money keeps pouring into Zillow, a Web site that computes the

value of homes

- New

York Times, remember Judith Miller and all her lies leading up

to the Iraq war Business

- StockPickr

- TheStreet

dollar daize

- The Creature from Jekyll Island,

about the true origination and character of the Federal

Reserve Minyanville

- notes: 11% solution, Barron's, Wall

Street Journal, Murdoch, in any 20 year period since 1920, market is

constant, in average earnings, growth, 1996-2007 bubble true then,

so next nine years have to compensate, average earnings are 11% of

book value, makes no difference what's going on politically,

economically ...etc.

billionaires

list billionaires

list- notes: shipbuilders sell dollars

and buy won in the forward market, hedge foreign-exchange-rate

risks, regulators probing surge in sales of forward contracts that

caused elevation of won to dollar, ... export boom expected to

continue, look into how forward sales and rising short-term

borrowings affect currency market, Iran sells more than 70 % of its

oil in euro and yen. source: Bloomberg

- notes: Citigroup BOD ...C. Michael

Armstrong , Chairman - Board of Trustees, Johns Hopkins Medicine,

Health System Corporation and Hospital; • Alain J.P. Belda, CEO,

Alcoa Inc.; • George David, CEO, United Technologies Corporation;

• Kenneth T. Derr, Chairman, Retired, Chevron Corporation; •

John M. Deutch, Institute Professor, Massachusetts Institute of

Technology; • Roberto Hernández Ramírez; Chairman, Banco

Nacional de Mexico; • Andrew N. Liveris; CEO, The Dow Chemical

Company; • Anne Mulcahy, CEO, Xerox Corporation; • Richard D.

Parsons, CEO, Time Warner Inc.; • Judith Rodin, President,

Rockefeller Foundation; • Robert E. Rubin, Chairman, Citigroup

Inc.; • Robert L. Ryan; Chief Financial Officer, Retired,

Medtronic Inc. • Franklin A. Thomas, Consultant, TFF Study Group

|

- PIMCO’s

Bill Gross "... view is that a U.S. Fed easing cycle

historically has required a destination of 1% real short rates or

lower. Under a conservative assumption of 2½% inflation, that

implies Fed Funds at 3¾% or so over the next 6-12 months. Actually

that’s only two, 50 basis point reductions, something that could,

but probably won’t, be accomplished by year-end. Don Kohn’s

asymmetric elevator will likely be interrupted by false hopes of a

housing bottom, fears of a dollar crisis, or misinterpreted one

month’s signs of employment gains and faux economic strength. The

downward path of home prices, however, will dominate Fed policy over

the next several years as will the lingering unwind of related

financial structures and derivatives that have yet to be discovered

by the public, and marked to market by their conduit holders."

-

- Rediff

US current account deficit is current account

surplus in countries that export to US, to cover US borrows from

those countries, holding up the value of the dollar. Asian countries

are just as much to blame as US. Limitations to system. Global

imbalance. US has to have 5%

interest rate to keep foreign investment flowing in... so can't cut

rates to stimulate in face of 'housing' recession

- Telegraph.uk

Sept 2007, "The

Chinese government has begun a concerted campaign of economic

threats against the United States, hinting that it may liquidate its

vast holding of US treasuries if Washington imposes trade sanctions

to force a yuan revaluation. ... such action could trigger a dollar

crash at a time when the US currency is already breaking down

through historic support levels. ... It would also cause

a spike in US bond yields, hammering the US housing market and

perhaps tipping the economy into recession. It is estimated that

China holds over $900bn in a mix of US bonds. ... He Fan, an

official at the Chinese Academy of Social Sciences, went even

further today, letting it be known that Beijing had the power to set

off a dollar collapse if it choose to do so. ... gold

bullion, regarded as the best insurance against any turmoil in

global money markets, but reserves in UK, US may not be pure gold,

cracks fissures,

- Bloomberg

The dollar dropped to a record low against the euro, now worth more

than $1.40. While a weakening dollar can give a lift to shares of

companies that are big exporters, it also threatens to make

inflation worse because of the United States' heavy reliance on

imported goods. ...

- it would take a "change in attitude from the

investment side of the market" to send gold prices

significantly lower, ... A big stretch We're really

talking about something short of a miracle for gold prices to drop

from their current levels ... India could slow its

consumption, the U.S. could go into a recession, the U.S. stock

market could rally further, taking the attention away from gold, and

the credit crunch could continue and spur massive gold sales, ...

The credit crisis would have to abate, western housing markets

stabilize and the U.S. consumer continue on the merry spending spree

...

- CommodityOnline

(market crash) "The second act is when

the market finds out how big the losses are and who has them. This

is what happened in 1998. The market fell hard in August of that

year due to turmoil in the international bond market, bounced, in

September, and then dropped hard again to form a double bottom when

the Long-Term Capital hedge fund blew up ... the first act of

a financial crisis - and normally those unfold in two stages.

The first being when people realize there is a big problem causing

huge frightening losses the extent of which are unknown and are

forcing institutional investors to selling due to margin calls and

redemptions. ... The second act is when the market finds out

how big the losses are and who has them. This is what happened in

1998. The market fell hard in August of that year due to turmoil in

the international bond market, bounced, in September, and then

dropped hard again to form a double bottom when the Long-Term

Capital hedge fund blew up. ... The

Fed is supposed to lower rates as you approach the trough of a

business cycle, not right up near the top when there is inflation.

To do so is very dangerous and if Bernanke continues this course he

will destroy

the value of the dollar.

Citigroup,

off balance sheet structures, SIV, isn't that also called fraud? Citigroup,

off balance sheet structures, SIV, isn't that also called fraud?- TheStreet

How the Market Will Unravel ... "Lower Business Spending Based

on a Weakening Domestic Economy: In the coming months, the credit

market's unwind will most likely be felt by a reduction in hirings

and delays in business fixed investment. Last week's ISI Group

surveys -- trucking and shipping, U.S. CFO Diffusion Index (Fuqua),

U.S. Small Business Optimism Index, the North America Business

Confidence Index, U.S. CFO Employment Expectations (Fuqua), U.S. CFO

Capital Spending Expectations (Fuqua) and U.S. Small Business Trends

(NFIB) Capex Plans -- all point to multiyear lows in confidence and

are supportive of a marked slowdown in business spending.

- A point is 1% of the total mortgage amount, charged

as prepaid interest. A "repo" is a short-term

agreement that allows dealers to sell government securities to

investors and buy them back the following day.

- Strong,

Ed "Central banks around the world no

longer have to load up on dollars simply because there is no

alternative; the euro is one, the Chinese yuan will soon become

another. As far as the economy is concerned, the strong dollar

has allowed the US to live beyond its means for far longer than has

been healthy either for America or the global economy as a

whole. A high dollar meant exports into the US were cheap, and

that kept both inflation and interest rates low. Easy credit

terms meant that the US has had not one but two speculative booms

over the past decade, the first in dot com shares, the second in the

housing market. Growth has been artificially boosted and the trade

deficit has exploded."

- Long-term Treasury prices increase on drop in new

home sales, Treasuries, which carry a government

guarantee, often perform well when data indicates the economy is

weakening and investors should buy low-risk assets. Auctions include

an an indirect bid, a category that is carefully monitored

because it includes foreign central banks. High indirect bids soothe

worries that foreign governments are scaling back their holdings in

Treasuries. The benchmark is the 10-year Treasury note ...

Prices and yields move in opposite directions. The 30-year

long bond The 2-year note The yield on the 3-month

Treasury bill

- Comptroller

General Walker / WMR "Comptroller General Walker:

Financial tsunami coming ... David Walker, the

Comptroller General of the United States, urged journalists gathered

in Washington for the annual meeting of the Society of Professional

Journalists to start covering with more honestly the impending

financial crisis facing the United States. Walker is the head of

Congress' Government Accountability Office (GAO), a non-partisan

oversight and chief accountant position with a 15-year term. ...

Walker warned that with the first "baby boomer" retiring

on January 1, 2008, a tsunami of increased non-discretionary

spending for Social Security, Medicare, and Medicaid will bankrupt

the United States government and may force U.S. bonds into

"junk" status in 20 years. ... The Comptroller

General also warned that the U.S. work force is decreasing and, as a

result, so will the tax base. He also said that the United States

currently ranks 16 out of 28 among industrialized nations in leading

quality of life indicators, including health care, the environment,

personal savings, and education.

- Bloomberg

"Central banks from Bogota to Mumbai are imposing

foreign-exchange curbs to take control of their soaring currencies

from traders dumping the dollar. In Colombia, international

investors buying stocks and bonds must leave a 40 percent deposit at

Banco de la Republica for six months. The Reserve Bank of India

created a bureaucratic thicket to curb speculation by foreign money

managers. The Bank of Korea is investigating trading of currency

forward contracts to limit gains in the won, now at a 10-year

high. Instead of using currency reserves or interest rates to

influence foreign exchange markets, central banks and finance

ministries are setting up obstacles to keep the falling dollar from

threatening company profits and economic growth. The U.S. currency

slumped 10 percent this year against its biggest trading partners,

the steepest decline since 2003, while Treasury Secretary Henry

Paulson has reiterated that the U.S. supports a ``strong'' dollar."

- Any country with loads of debt, even the US, is

tempted to inflate its currency, reducing its value, but erasing the

debt, destructive spiral ... poor economic policy.

- Bloomberg

"School districts, counties and cities across Florida sought to

raise cash after being denied access to their deposits in a $15

billion state-run investment fund. The Jefferson County school

district was forced to take out a short-term loan to cover payroll

for the 220 teachers and other employees in the system after $2.7

million it held in the pool was frozen yesterday. At least five

other districts also obtained last-minute loans, said Wayne Blanton,

executive director of the Florida School Boards Association. ...

terms ..classic run-on-th-bank, and Bloomberg

"Money market rates rise ...

- Bloomberg

Survey companies: 4CAST Ltd., Action Economics, Aletti

Gestielle SGR, Ameriprise Financial Inc, Argus Research Corp., Banc

of America Securitie Bank of Tokyo- Mitsubishi, Bantleon Bank AG,

Barclays Capital, BMO Capital Markets, BNP Paribas, Briefing.com,

Calyon, CIBC World Markets, Citi, ClearView Economics, Commerzbank

AG, Credit Suisse, Daiwa Securities America, Danske Bank, DekaBank

Desjardins Group, Deutsche Bank Securities, Deutsche Postbank AG,

Dresdner Kleinwort, DZ Bank, First Trust Advisors, Fortis Helaba,

Herrmann Forecasting, High Frequency Economics, Horizon Investments,

HSBC Markets, IDEAglobal, IHS Global Insight Informa Global Markets,

ING Financial Markets, Insight Economics, Intesa-SanPaulo, J.P.

Morgan Chase, Janney Montgomery Scott L, JPMorgan’s Private

Wealth, Landesbank Berlin, Landesbank BW, Lloyds TSB, Maria Fiorini

Ramirez Inc, Merrill Lynch, MFC Global Investment Man, Moody’s

Economy.com, Morgan Keegan & Co., Morgan Stanley & Co.,

National Bank Financial, National City Corporation, Natixis, Newedge

, Nomura Securities Intl., PNC Bank, RBC Capital Markets, RBS

Greenwich Capital, Ried, Thunberg & Co., Schneider Trading

Associa, Scotia Capital, Societe Generale, Standard Chartered, Stone

& McCarthy Research, TD Securities Thomson Financial/IFR, UBS

Securities LLC, Unicredit MIB, University of Maryland, Wachovia

Corp., Wells Fargo & Co., WestLB AG Westpac Banking Co.,

Wrightson Associates

|

no

more Bush Clinton?

no

more Bush Clinton? billionaires

list

billionaires

list

Citigroup,

off balance sheet structures, SIV, isn't that also called fraud?

Citigroup,

off balance sheet structures, SIV, isn't that also called fraud?