- Bilaterals.org

against bilateral trade and investment agreements to benefit transnational

corporations.

- Counterpunch

How the world could stop Bush, Dump Dollars, ... The US is totally

dependent upon foreigners (China, Japan, largest) to finance its

budget and trade deficits. By financing these deficits, foreign

governments are complicit in the Bush Regime's military aggressions

and war crimes

- Democratic

Underground "Saudi Arabia has refused to cut interest rates

in lockstep with the US Federal Reserve for the first time,

signaling that the oil-rich Gulf kingdom is preparing to break the

dollar currency peg in a move that risks setting off a stampede out

of the dollar across the Middle East."

- Economic Policy Institute

search: export subsidies

- ElaineSupkis,

blog China, Japan, Taiwan, South Korea and Hong Kong have channelled

immense foreign reserves into American government bonds, to prop up US

dollar, and hold down American % rates, ... Bush ... use $ as

imperialist tool, controlled destabilization and collapse of the $,

- Institute

for Agriculture and Trade Policy for economically sustainable

communities

- New Economy Index

Progressive Policy Institute, Chinese dumping dollars would cause a spike in

US bond yields,

- DissodentVoice,

Socialism, 1 percent of US population owns 50 per cent of the

wealth. obscene!

- Online

Journal "China’s "nuclear option" to dump the

dollar is real"

- MarketOracle.co.uk

- Notes: Among those filing

bankruptcy were New Century Financial Corp., Quality Home Loans,

Aegis Funding, HomeBanc Mortgage Corp. and People's Choice Financial

Corp. ... "That number is likely to grow," Challenger

said. "I think that's the big question that will play out over

the next six months: What are the repercussions from this hit to

subprime on the economy? What other sectors will it infect? Housing

and finance are the two areas that seem most likely to be in the

direct path of the storm." Money.CNN

- World Social Forum opposed

to the domination of the world by capital, imperialism.

|

- BBC

Market Data

- 321Gold

range of value of dollar 160-79, governments and institutions that

have foolishly accumulated hundreds of billion of US dollars are

afraid to dump them, would trigger panic, devalue too quickly,

- Bloomberg

Rising Euro is what China needs to dump dollar

- Bloomberg,

Canada, Subprime Panic Freezes $40 billion of Canadian Commercial

Paper, search terms: September 25, 2007, Baffinland Iron Mines Corp,

freeze in market for short-term debt, Toronto, defaults on subprime

mortgages in Southern California and Florida, cash in commercial

paper, debt backed by mortgages, corporate bonds, auto loans, all

stable for decades, yielded 1 percent more than commercial paper,

government debt sales fell because of government surpluses,

Libor is benchmark for commercial paper rates, no alternative plans

for liquidity, locks up system,

- CommodityOnline

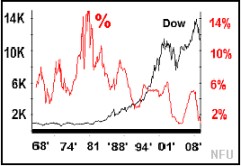

The Fed saved the stock market Aug 2007

- DailyFX

- DailyReckoning

- EconPapers

Access to RePec, worlds largest collection online Economics

- Financial

Sense, China dumping dollars,

- GoldandSilverInvestments.com

- GoldSeek,

meltdown, sept

22

- Gulf

Times "Middle

Eastern investors, led by the Arabian Gulf, will spend as much as

$300bn on Chinese equities through 2020 to build relationships in

Asia and secure higher returns, according to Merrill Lynch.

- Hometrack.uk housing price index

- Institute

for International Economics George Soros on BOD

- Inter-American

Dialogue support for

free-trade deals falling

- Kitco

- MarketOracle.co.uk

recessions Third Leg of Bear Market

- Market

Watch Bond reinvestment risk, in a interest rate cut environment

- MoundReport

- RePEc University

of Connecticut, Dept of Economics, Ideas

- RobertReich's

Blog "there's not much politicians can do to stimulate or

retard the economy, ... tax policies included, ... deficits do

matter, spook the market into fearing the fed will raise % rates to

counteract inflation, balance of payment deficits matter because large

ones can cause speculators to dump dollars, generating inflation, and

pushing up interest rates,

- StockMarketCrash.net

- Telegraph.uk

China threatens 'nuclear option',

- Tom Paine

- TheStreet

dollar daize

- This

is Money.uk dfg

- TreasuryDirect.gov

- WorldWatch Institute

|

coming soon?

coming soon?- Barclays

- Bank of

England are they on

the hook for all deposits if hedge funds raid Northern Bank? Money

CNN.com

- Bloomberg

"Sept. 19 ... As many as half of the 450,000 subprime

borrowers whose mortgage payments increase in the next three months

may lose their homes because they can't sell, refinance or qualify

for help from the U.S. government."

- BreakingNewsUpdate,

Debka, Situation Room, October Market Crash, commodities, inflation

- Council

on Foreign Relations

- DLC

Democratic Leadership Council

- Fool.com

Market crashes

- HSBC

- Library

of Economics and Liberty

- Minyanville

Ron Paul " ... I think moral hazard begins at the very moment

that we create artificially low interest rates which we constantly

do. And this is the reason people make mistakes. It isn’t because

human nature causes us to make all these mistakes, but there is a

normal reaction when interest rates are low that there will be

overinvestment and malinvestment, excessive debt, and then there are

consequences from this."

- MSN,

Epic Bear Market

- New

York Federal Reserve, search data on China dollar

- New

York Times, remember Judith Miller and all her lies leading up

to the Iraq war Business

- Royal Institution of Chartered

Surveyors

- Zillow

notes:Defaults are soaring. Home sales and prices are falling.

Business is thin for real estate agents and mortgage brokers. But

the money keeps pouring into Zillow, a Web site that computes the

value of homes

|

- Sovereign Wealth Funds, vehicle to dump dollars without

being reported, but will eventually be exposed. and Wikipedia

"Sovereign wealth fund (SWF) (Sovereign

wealth funds) is a fund owned by a state composed of financial assets

such as stocks, bonds, property or other financial instruments.

... Sovereign wealth funds are, broadly defined, entities that can

manage the national savings for the purposes of investment. The

accumulated funds may have their origin in, or may represent foreign

currency deposits, gold, SDRs and IMF reserve position held by central

banks and monetary authorities,. along with other national assets such

as pension investments, oil funds, or other industrial and financial

holdings. These are assets of the sovereign nations which are typically

(but not necessarily) held in domestic and different reserve currencies

such as the dollar, euro and yen. The names attributed to the management

entities may include central banks, official investment companies, state

pension funds, sovereign oil funds and so on. ... There have been

attempts to distinguish funds held by sovereign entities from foreign

exchange reserves held by central banks. The former can be characterized

as maximizing long term return, with the latter serving short term

currency stabilization and liquidity management. This distinction points

in the right direction, but is still unsatisfactory. Many central banks

in recent years possess reserves massively in excess of needs for

liquidity or foreign exchange management. Moreover it is widely believed

most have diversified hugely into assets other than short term, highly

liquid monetary ones (almost no data is available however to back up

this assertion). Some central banks even have begun buying equities, or

derivatives of differing ilk (even if fairly safe ones, like Overnight

Interest Rate swaps)."

|

|

|

|

|